8Q Expense Report Automation

SuiteWorld 2025 Deal

Sign up for an 8Q Expense Report Automation Demo – Get the 8Q Support Bundle FREE!

Key Features & Benefits

Credit Card Receipt Capture via card swipe/scan directly imported into NetSuite within 8 hours.

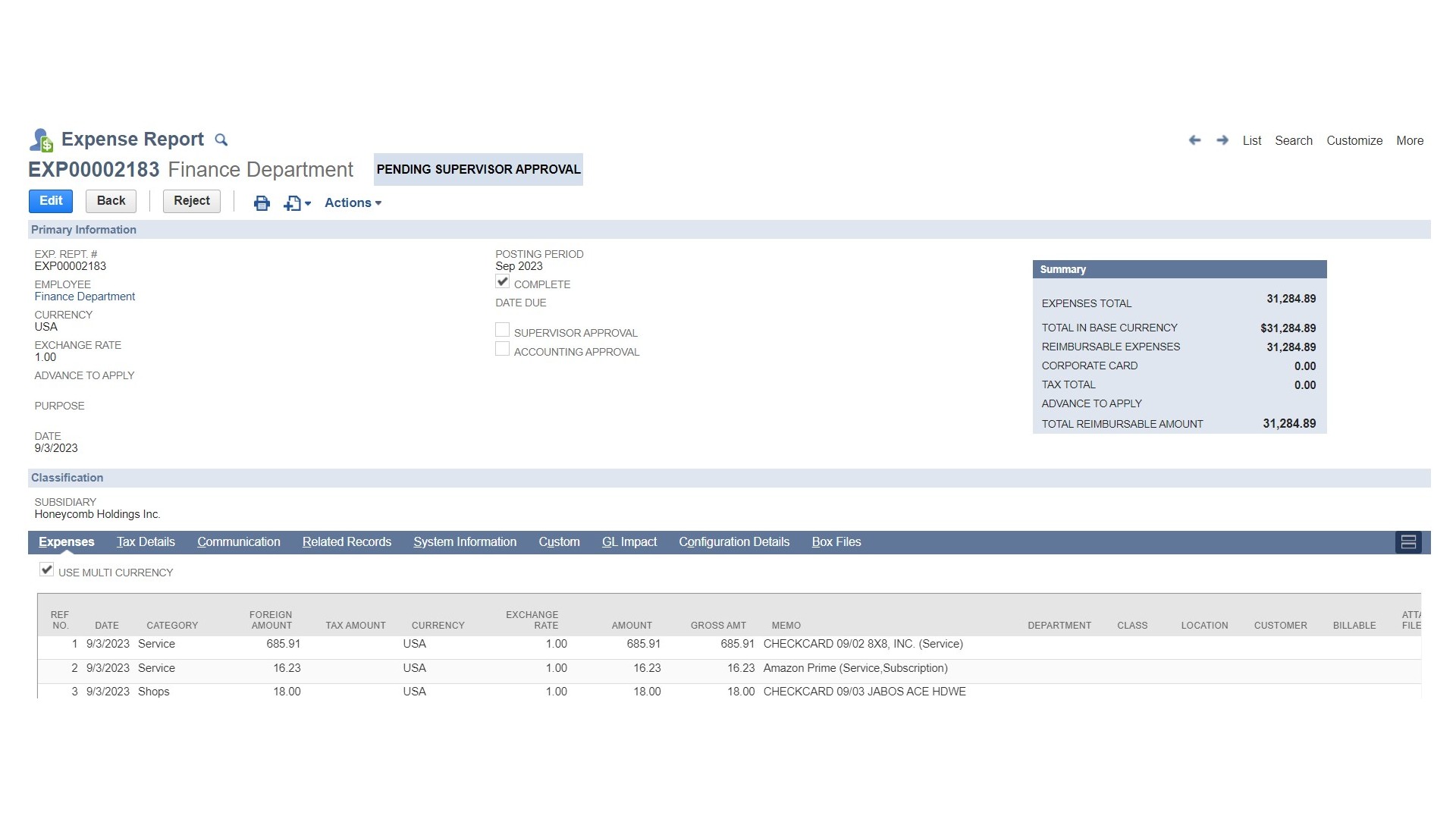

Automated creation of Expense Reports by credit card into individual NetSuite expense reports.

Live, real-time automation of credit card transactions from any location directly into NetSuite Expense records with mirror of expense report in the NetSuite Mobile App.

Auto-creates expense reports with automatic attachment of card receipts to individual expense lines.

Credit Card Receipts are captured via phone camara and then email directly into NetSuite and attached to the line level relating to specific expense.

Also, receipts can be attached via the NetSuite Mobile App and then approved inside NetSuite.

Supports multiple approval processes for expense reports.

Automated expense category matching to individual expenses.

Reconciles expense reports from credit card transactions directly to individual Credit Card Payables accounts.

Supports Parent and Child Credit Card Accounts for robust organizational oversight.

Reduce manual effort, improve accuracy, enhance compliance, and accelerate expense report processing and reconciliation within NetSuite.

Supports expense advances.

Supports Corporate Cards, Personal Cards, and Purchase Cards.

What's in it for you?

Dramatically reduce manual effort, improve data accuracy, enhance compliance, and accelerate financial close with unparalleled automation and streamlined expense management within NetSuite.

- Ensures secure data handling

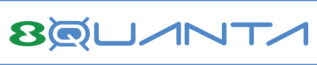

Granular Spend Rules

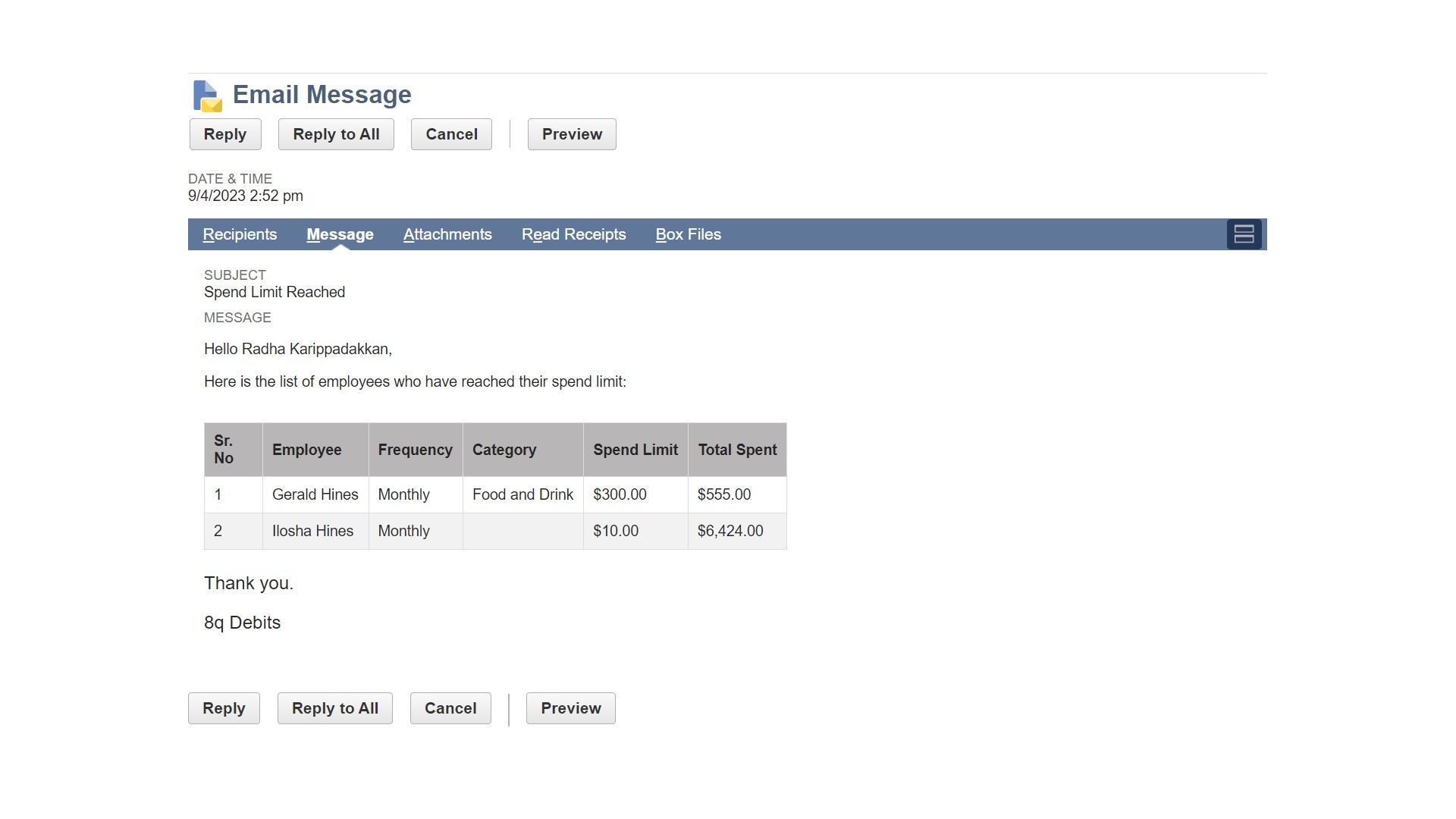

- Enforce spend rules by NetSuite User and by card

Flexible Spend Limits

- Set daily, monthly, and category-specific spend limits

8Q ERA Presentation

For Users Who Never Used the App

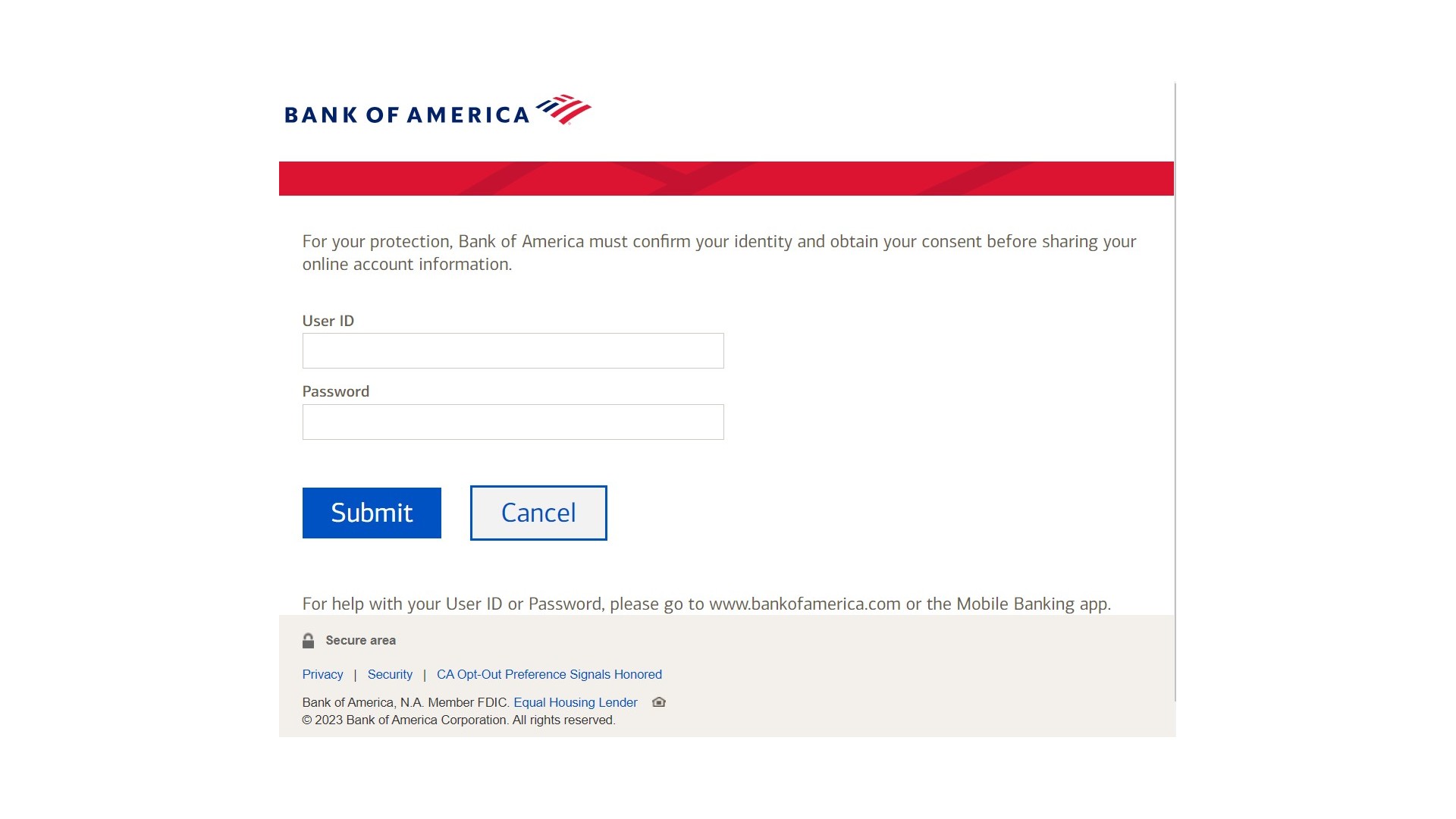

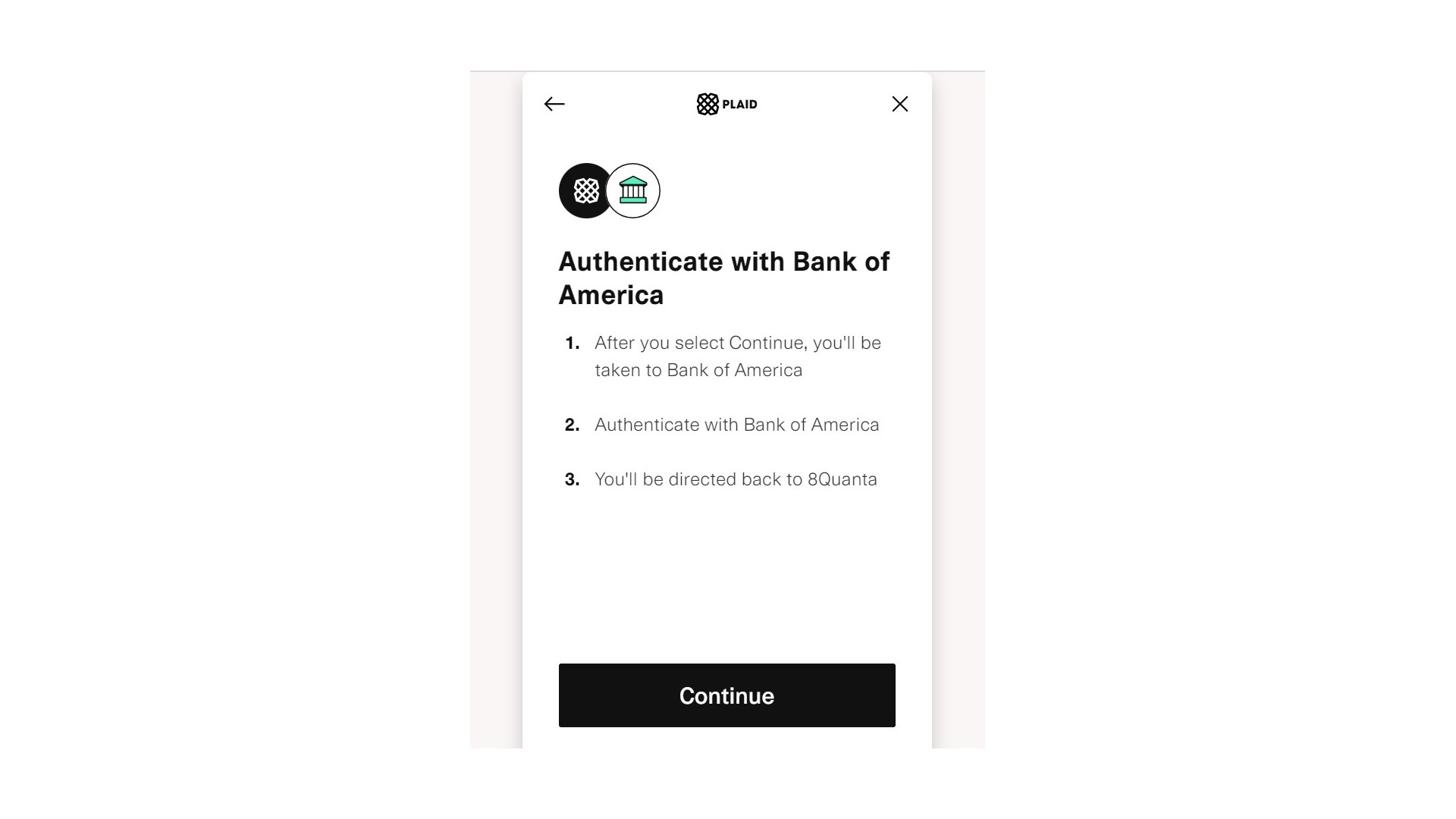

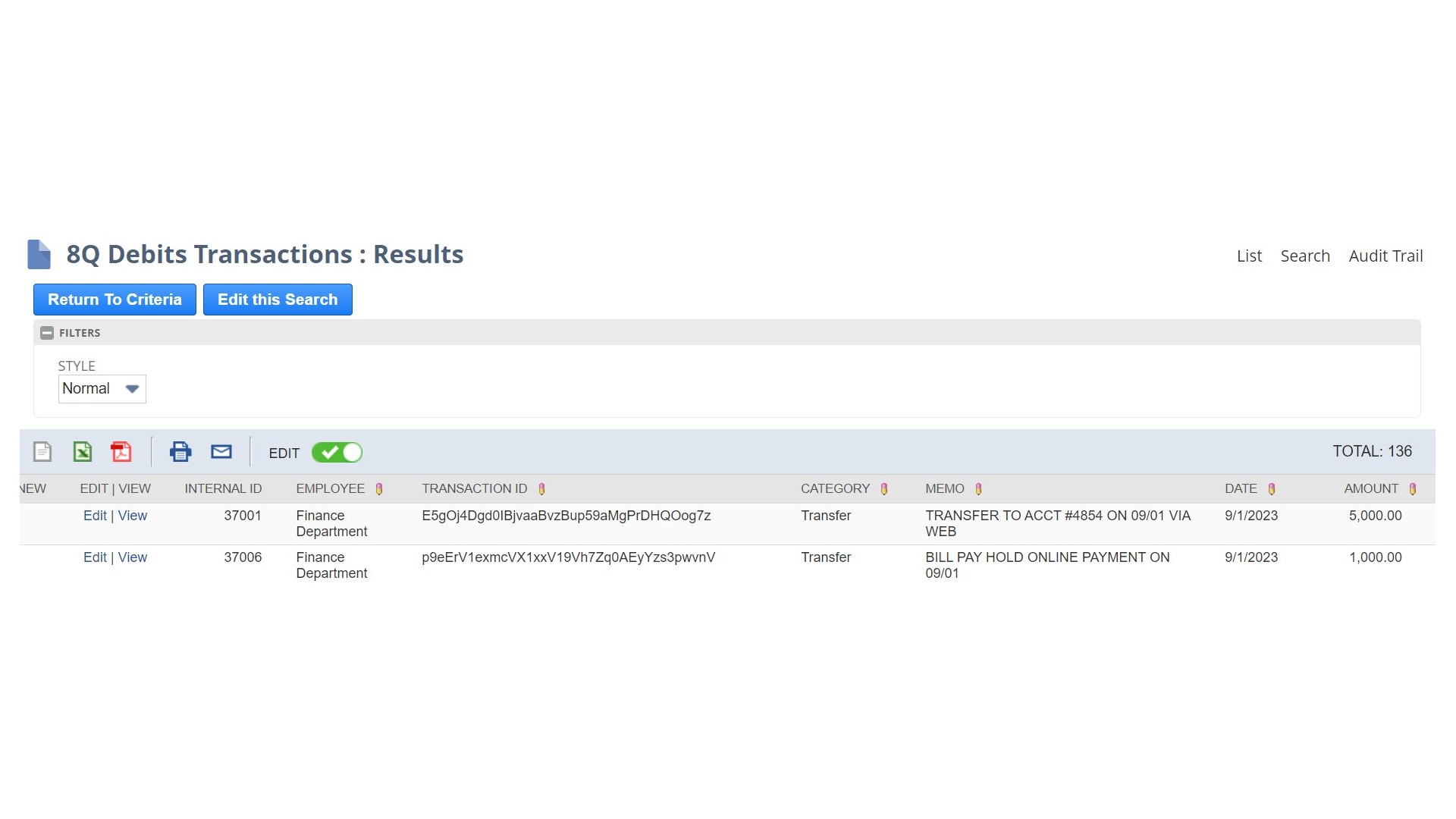

8Q ERA imports credit card transactions through a connection with Plaid (and soon other services) and links them to the respective NetSuite account.

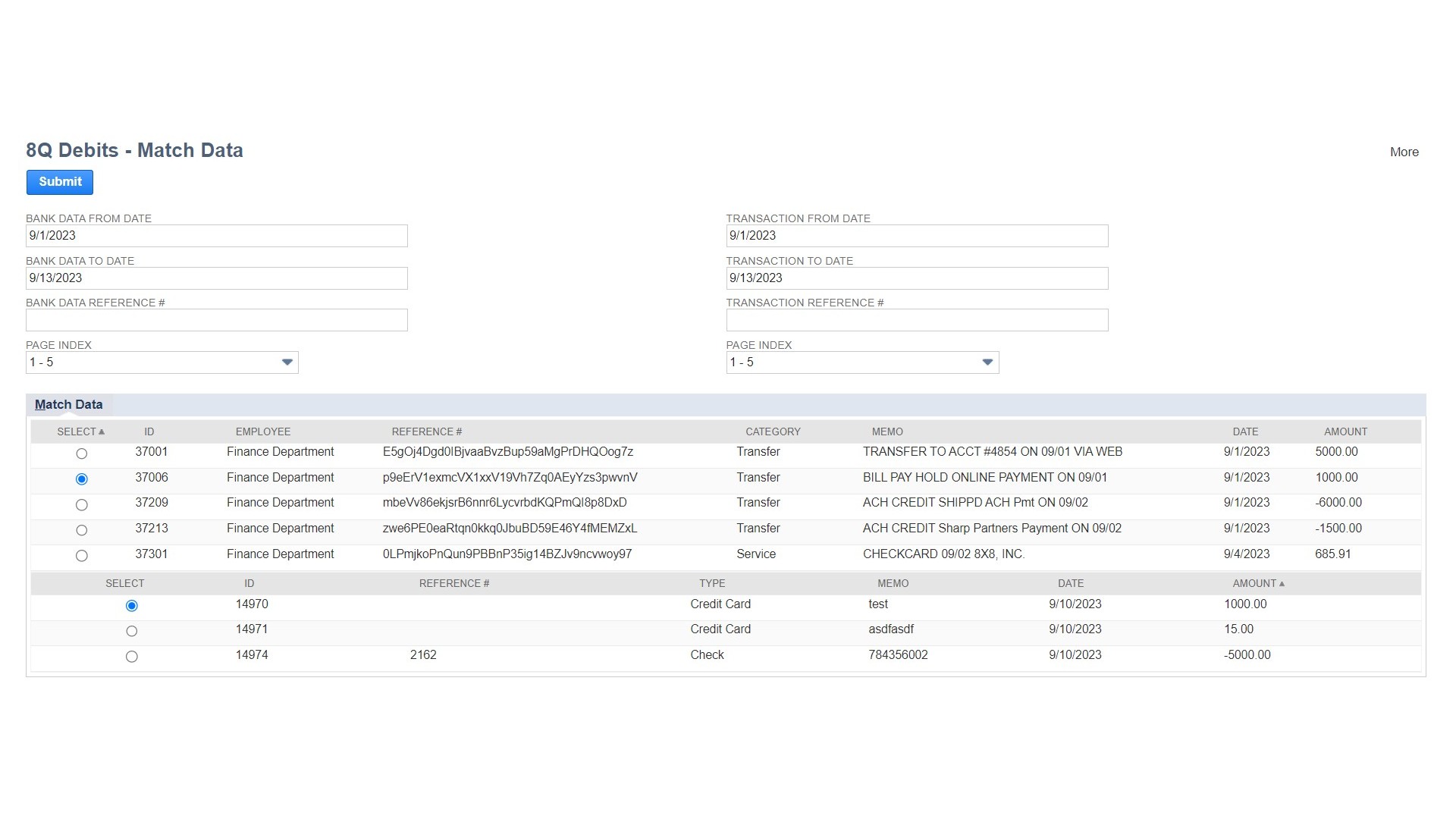

Transactions are automatically matched with corresponding entries in NetSuite, making reconciliation seamless.

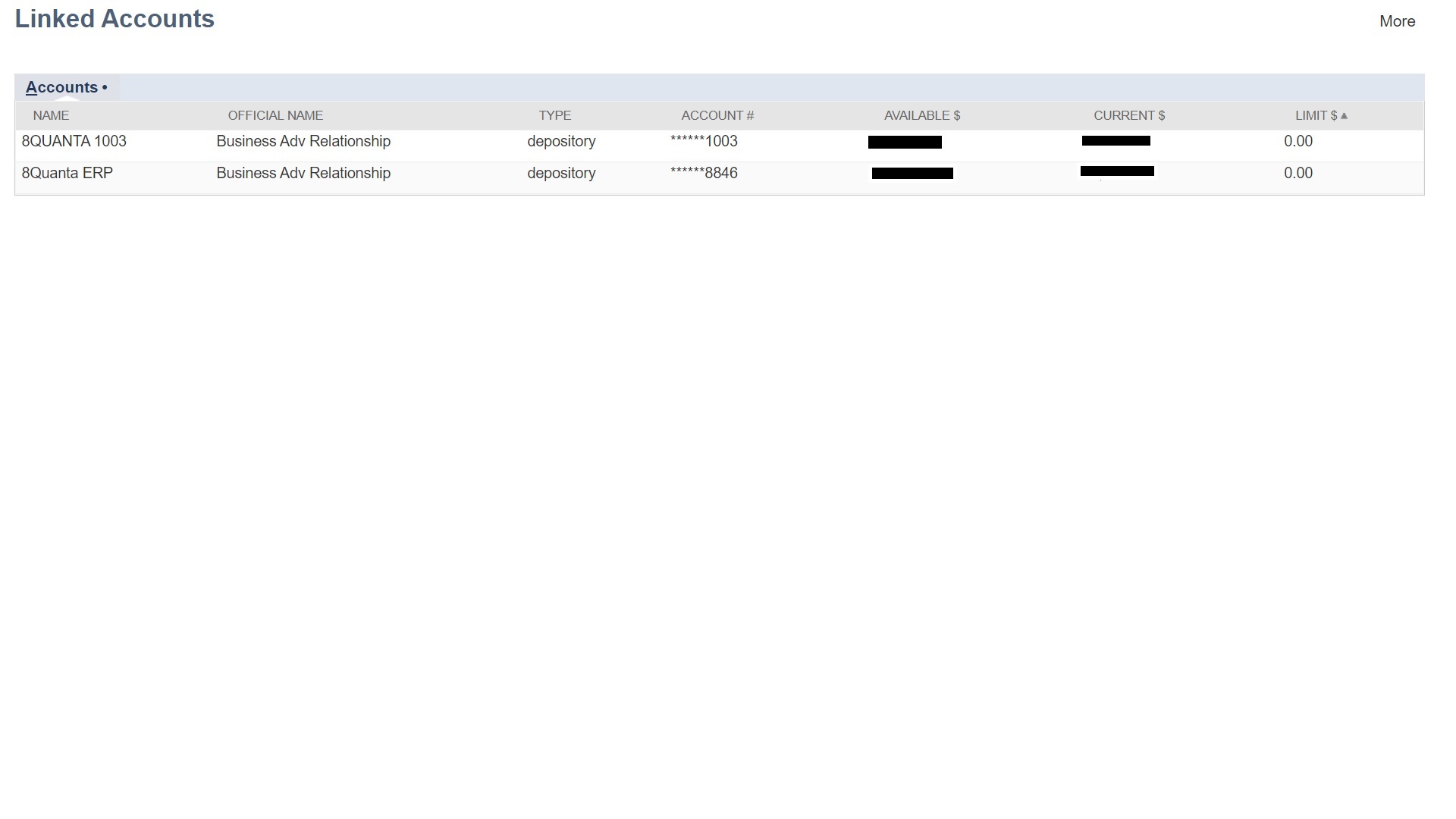

Yes, 8Q ERA supports multiple cards and assigns them to specific employee records in NetSuite.

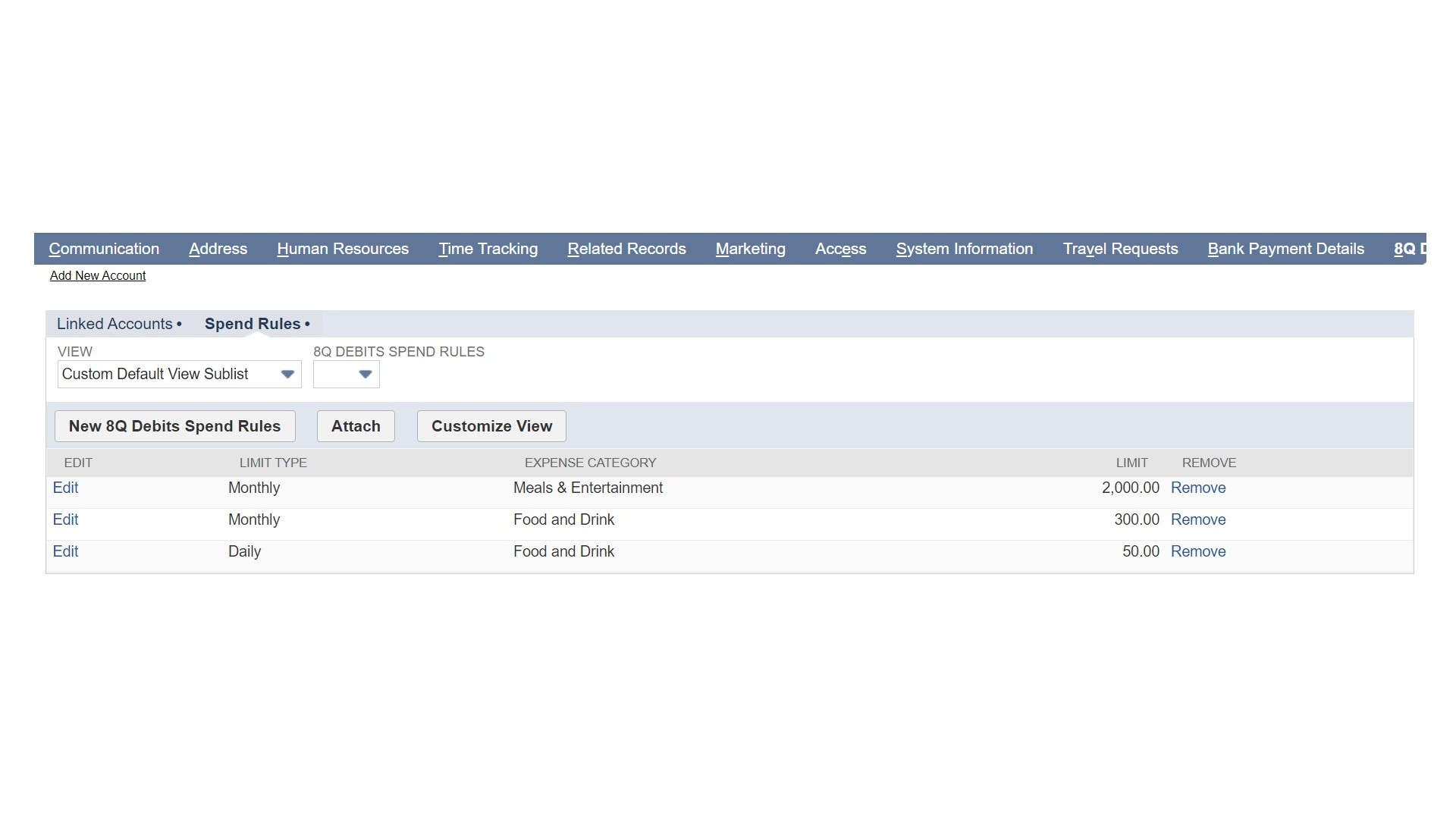

8Q ERA uses Plaid, a secure open banking system, to encrypt sensitive data during transfers.

No, 8Q ERA automates transaction entry, eliminating the need for manual data input.

For Users Who Recently Started

Link your credit card to 8Q ERA by selecting the institution (e.g., Amex, Bank of America) and completing the authentication process using Plaid.

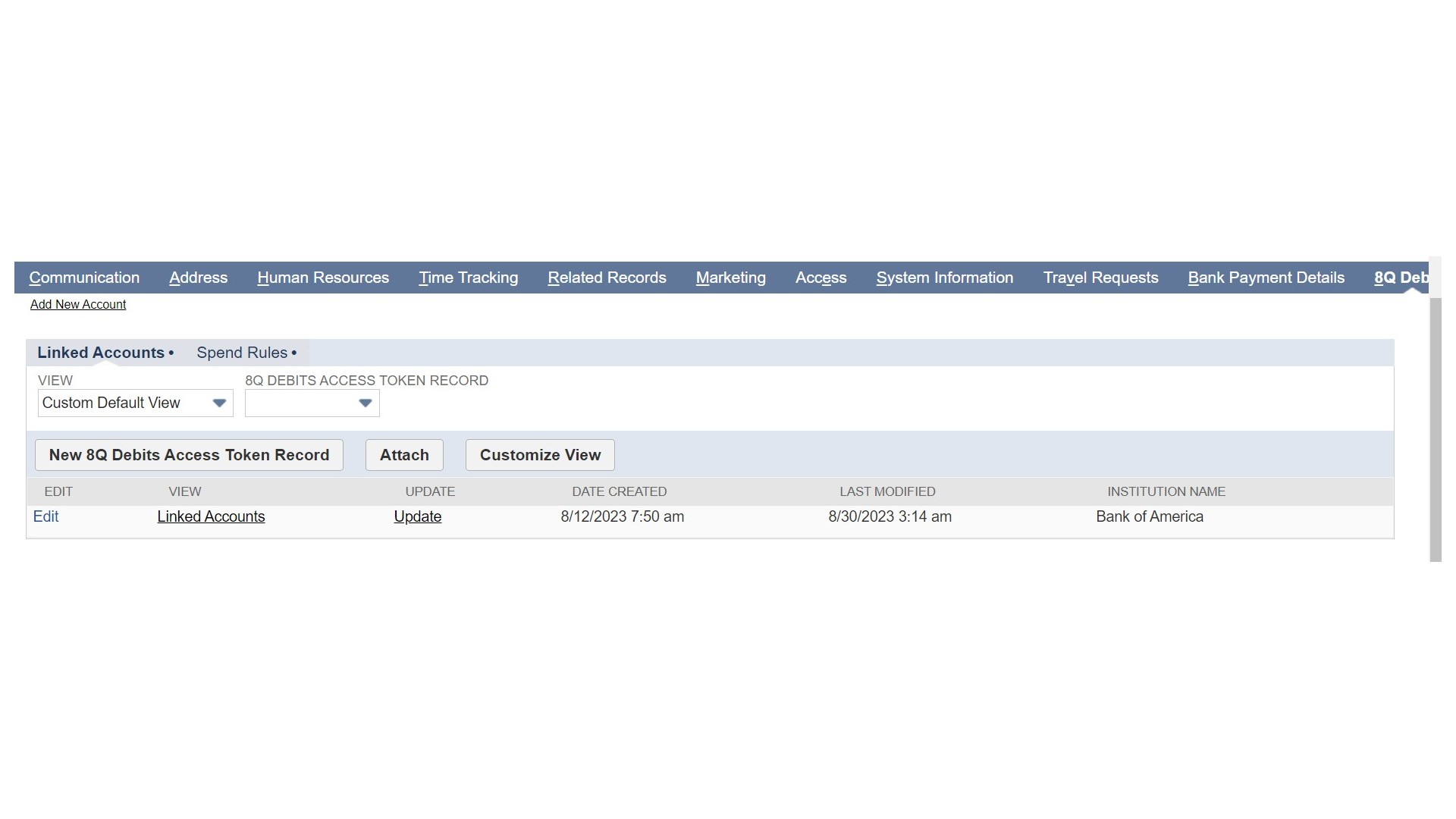

Tokens are secure credentials that authenticate and maintain the connection between your NetSuite account and credit card provider.

In NetSuite, navigate to the employee record and link the card using the correct token corresponding to their credit card account.

Delete one of the duplicate transactions and reconcile the correct entry. Duplicates may occur due to issues with the transaction feed.

Access the expense report list in NetSuite to edit, review, and approve reports before posting them to the bank match.

8Q ERA allows allocation of a single transaction across multiple categories or expense accounts within NetSuite.